Hello Glen Park and Happy Mid-Wintertime! It sure has been rainy (needed) and cold (brrr). I even heard that next week it may snow! Would be fun to take another picture sitting at a picnic table in the backyard like I did in my childhood home in Noe Valley in 1976. Granted, I’ll look a little more awkward sitting on the table now, but I would definitely do it!

The market – wow, we have had quite a ride in the last year – the hottest market we’ve really ever seen going into spring of 2022 and then the big correction we all knew was coming sometime. The good news is that it looks like we are coming to a relatively soft landing. It was a shock – rates doubled in one year. That has NEVER happened in mortgage history. So, understandably, people froze and had to get their bearings on what they could afford, if they would dare move and give up their great interest rate on their current home, etc. Now that things are calming down, we will continue to see fluctuations with the rates, but nothing like what happened in one short year. Everyone is normalizing the new 5.5%-6.5% reality we are in and jumping back in. Open houses have picked up a lot in the last few weeks as have multiple offer situations and general buyer sentiment. Just look at the stats from this past month and what is currently in contract and how quickly versus the previous month. There is a new sense of excitement out there and we still have incredibly low inventory.

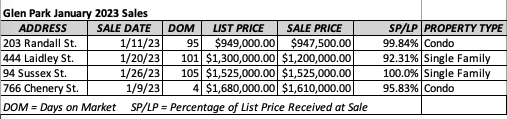

Here’s a look at what sold in the month of January.

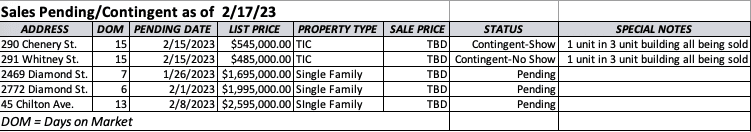

Here’s a look at what’s currently in contract.

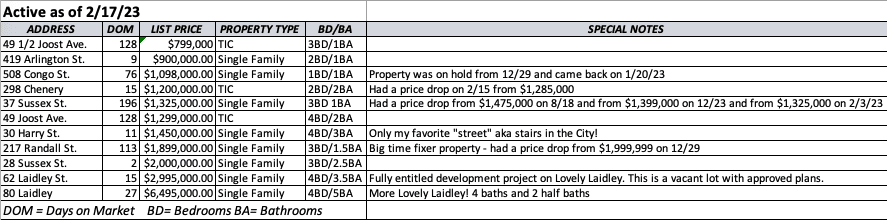

And lastly, the inventory that is currently available in Glen Park.

This month I thought I would leave you with a bit of info on the newest real estate tax – the San Francisco Vacancy Tax. This is the first time this will be affecting residential properties and if you own a multi-unit building or are thinking about buying one, you should definitely be aware of this new law going into effect in 2024.

San Francisco has recently passed a new vacancy tax, known as Proposition M, that would impose a progressive tax on apartments left vacant for more than 182 days in a tax year. The tax amount would depend on the size of the unit and the length of vacancy, ranging from $2,500 to $20,000 per year.

Here’s a chart of how the tax will work:

| Vacant for | Less than 1,000 sq.ft. | 1,000 to 2,000 sq. ft. | Over 3,000 sq. ft. |

| 1 year | $2,500 | $3,500 | $5,000 |

| 2 years | $5,000 | $7,000 | $10,000 |

| 3+ years | $10,000 | $14,000 | $$20,000 |

Exemptions to the tax include units owned by nonprofit organizations or governmental entities, units in buildings with two units or fewer (including single family homes), and condominium units with a homeownership exemption. There would also be exemptions for disasters, owner’s death, and construction periods.

All owners of apartments potentially subject to the tax must file a form with the Office of the Treasurer & Tax Collector to confirm the vacancy status of their unit by January 1st of each year starting in 2024. Failing to file the form would result in the unit being considered vacant and the tax being imposed.

The funds collected from the vacant unit taxes are to be placed in a Housing Activation Fund, which could be used for rental subsidies for people aged 60 and over or those earning less than 50% of the area median income, as well as for the acquisition and rehabilitation of apartment buildings with one-third or more units vacant and restricted to households earning less than 80% of the area median income.

Additionally, all properties in San Francisco are required to register with The City by March 2023 regardless of the type of property or if they are rented or not. Details here. You should consult with a tax professional to understand the full implications of the tax and the exemptions that may apply to your specific case.

For more San Francisco sales data, visit: thegoods-sf.com/AmandaMartin/

Amanda Martin

Amanda Martin