Happy New Year lovers of Glen Park! What a wet and wild entry we are having into this new year. Though copious amounts of rain are so welcome to keep the drought at bay, I know it’s been a bit of a disruptive deluge for many Glen Park residents. Having lived in a house on a slope with seeping groundwater I can feel the pain of water intrusion damage. That stuff finds a way to get anywhere and everywhere! So, I hope that as you read this you are cozy in your home and have not suffered any flooding, leaking, broken retaining walls, etc.

Taking a quick look at 2022 – what a ride it has been! In January we saw 100% of Glen Park properties sell over the asking price. In December that number was 60%. If we look at the rolling three months ending on Dec. 31st of 2021, an average of 66% of homes in San Francisco were selling over the asking price and that number was 82% for Glen Park. Fast forward to the rolling three months ending Dec. 31st of 2022 and those numbers are 43% and 44% respectively. That’s a pretty big difference that is indicative of a couple of things: 1) we are shifting to a healthier balanced market, and 2) selling strategies are shifting to bring prices more in line with value. I welcome this change. Prices in general seem to be down to 2017-2019 prices right now with some exceptions for properties that check all the boxes. In 2020 we saw that drawback of the market in the beginning of the pandemic, but as soon as people realized we had to make some big changes and this wasn’t going to be just a month, the scramble to buy bigger, better, farther, etc. pushed prices into the stratosphere as everyone was playing a giant game of musical chairs. This continued into the spring of 2022. Now we have a whole new mass mentality – hunker down and weather the storm of inflation, decreased stock market, increased mortgage rates, instability. “What’s going to happen?” That uncertainty results in lower inventory, but it also comes with lower buyer demand as people who can stay put have been doing just that. Demand is still there, but the overall volume is down. We are starting to see a little more movement as we are working our way into 2023. Buyers are realizing that even though the rates went up in a quick and dramatic fashion this year (basically doubling from the beginning of the year to the end!), historically speaking, they are still under the average and it’s unlikely we will be seeing those 3%-4% rates anytime soon, so they readjusting their budgets based on this new normal. Sellers are also coming to terms with our new slower market where you may not get 10 offers in five days. Once everyone is on the same page, we will see more movement in this healthier new market as we move towards spring.

Here are some sales highlights for Glen Park in 2022*:

- 78 single family homes were sold in 2021 (compared with 89 in 2021)

- 12 condos/TICs (tenancy in common) were sold in 2021 (compared with 26 in 2021)

- Lowest price single family home sale: 342 Sussex St. sold on 10/21/22 for $835,000 – this was actually a 2-unit building in practice, so probably not the best example. If we take that out of the picture, the lowest priced single family home sale was an original condition home that hadn’t been on the market since the first sale when the home was built in 1924 (according to the listing agent) at 728 Chenery for $1,100,000 that sold on 9/7/22.

- Highest price single family home sale: 46 Digby St. sold on 10/31/22 for $4,700,000 – this was a huge 4,269 sq. ft. home with designer touches, high end appliances, dry sauna, sweeping city, bay and Mount Diablo views, and a 2bd/2ba ADU to boot!

- Lowest price condo/TIC sale: 407 Miguel St. – this 450 sq. ft. condo was on the market on a couple of different occasions between 2020 and 2022 before finally selling on 11/22/22 for $537,500.

- Highest price condo/TIC sale: 131 Randall sold on 12/2/22 for $2,110,000. This property was described by the listing agent as a “true unicorn” because the unit had no neighbor above or below, 3-car parking, a south-facing garden. Basically this one checked a lot of boxes!

- Median sales price for single-family homes was $2,100,000 (compared with $2,202,000 in 2021). If you look at a rolling 6-month period rather than 12 months, I think it tells a more accurate story: $1,780,000 for 2022 (July-Dec) compared with $2,061,000 for 2021.

- Median sales price for condos/TICs was $1,175,000 (compared with $1,397,500 in 2021). Here’s looking at the 6-month rolling period: $1,100,000 for 2022 (July-Dec) compared with $1,410,000 for 2021.

- Median price per square foot for single-family homes was $1,205 (compared with $1,236 in 2021). Here’s looking at the 6-month rolling period: $1,147 for 2022 (July-Dec) compared with $1,189 for 2021.

- Median price per square foot for condos/TICs was $1,047 (compared with $975 in 2021) Here’s looking at the 6-month rolling period: $1,086 for 2022 (July-Dec) compared with $949 for 2021.

- Median days on market for single-family homes was 12 (compared with 11 in 2021). Here’s looking at the 6-month rolling period: 14 vs 15.

- Median days on market for condos/TICs was 31 (compared with 15 in 2021). Here’s looking at the 6-month rolling period: 34 vs 15.

So, what’s happened with sales in December?

Across all property types in December 2022 there were 65 price reductions in San Francisco and two in Glen Park (compared with none in either for December 2021).

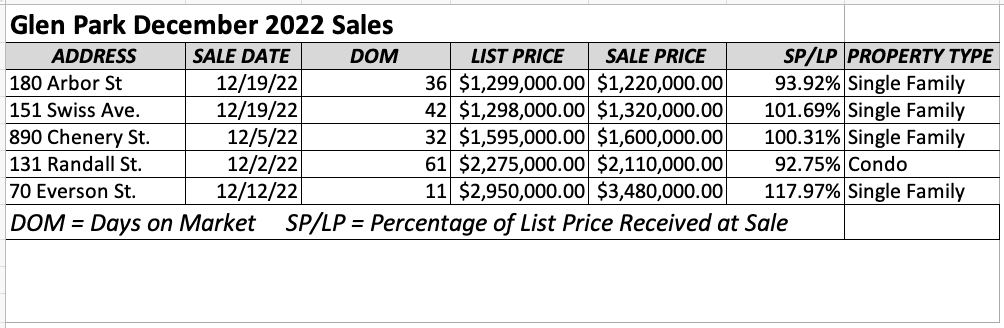

Here are the sales in Glen Park for the month of December:

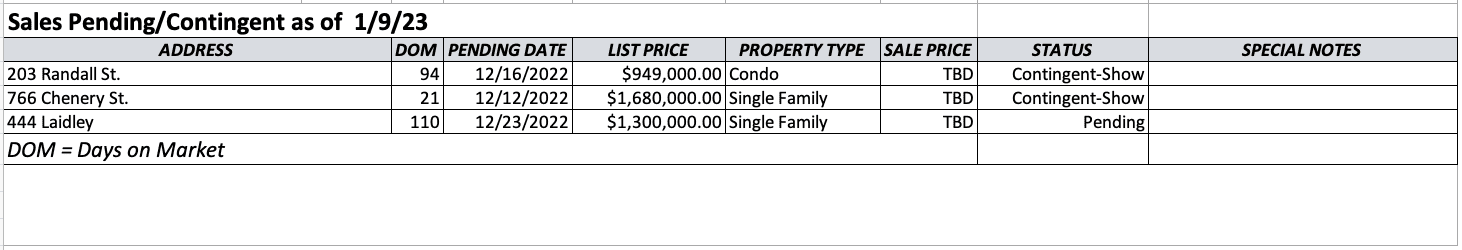

Properties currently contingent/pending in Glen Park:

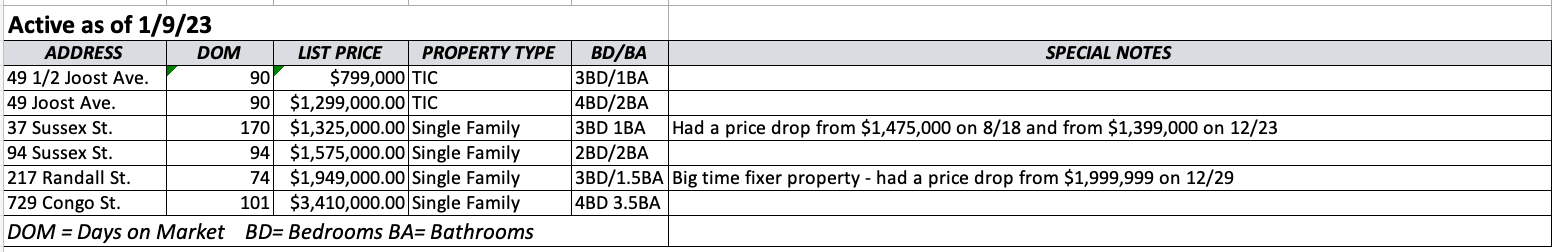

Properties currently active in Glen Park:

A few of the active properties that were on the list last month have fallen off without going into contract:

- 53 Wilder, 42 Wilder, and 131 Laidley were all pulled from the market after long marketing periods as the sellers decided to rent rather than sell.

- 62 Laidley is off-market temporarily but will be back soon – call Declan Hickey if you have questions: 415-902-2446

- 80 Laidley – this special home on Lovely Laidley will be coming back to market in mid to late January. Call team@realsproperties.com if you have questions.

Happy to discuss real estate any time – just give me a shout!

For more San Francisco sales data, visit: thegoods-sf.com/AmandaMartin/

*Data pulled from SFAR MLS

Amanda Martin

Amanda Martin